Success in the Wine Industry: Winning Younger Consumers

The second article in a series by MJ Dale of Customer Vineyard

ARTICLE SUMMARY

The wine industry is facing challenges in attracting younger consumers, but there are still significant opportunities to engage this demographic in key U.S. cities and by offering diverse wine varietals at affordable prices. To tap into this potential, focus on understanding and connecting with these consumers through data insights. Learn from successful competition in the beverage alcohol market, such as spirits, and adapt traditional direct-to-consumer (DTC) strategies to leverage the wine industry's strengths, including its natural, grape-based products and established wine club subscriptions tailored for younger buyers.

I. PLACE: Where Young DTC Wine Consumer Spend Is Growing

By now it’s well known that the wine Industry isn’t connecting as well with younger consumers -especially those ages 25-40. For any negative trend, however, there is also hidden opportunity. Once again, Customer Vineyard turns to our partner Sovos ShipCompliant’s impressive & anonymized DTC dataset of ~30M consumers and $20B+ in wine shipments for answers.

From our research, it’s clear younger consumers continue to invest in DTC wine purchases in various U.S. cities, defying the national trend. The map above shows the top 10% of young DTC wine consumer spending – with key cities highlighted that have delivered 5 + years of consecutive growth (both pre and post covid).

Notable cities with sustained growth in wine sales among this age group include:

II. PRODUCT: Preferences of Younger Wine Consumers

The below chart highlights DTC wine $ spending by age group and average bottle price paid for the top 8 varietals.

Further researching DTC wine spending by age and varietal at a more detailed level --we also learned these younger consumers:

Buy cabernet, red blends, pinot noir and chardonnay more than any other varietal via DTC.

Appear to like red blends more and chardonnay less than older consumers. They also like Rose and Sauvignon Blanc proportionally more than older cohorts.

Spend significantly more on “other varietals” – often buying something other than one of the top 20 varietals sold DTC. (See chart below)

III. PRICE: Trends Among Young Wine Consumers

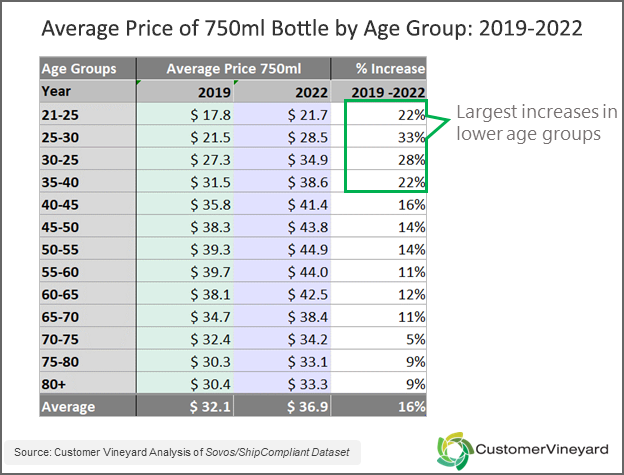

Since 2019 the average price paid for a bottle of wine via DTC has gone up 14% and now stands at about $37.00.

Interestingly, the average price paid per bottle by younger consumers increased 26% between 2019 and 2022. Older consumers, by contrast, paid only 11% more on average per bottle in this same timeframe -- below even the average bottle price increase of 14%.

This disproportionate impact on younger consumers is likely a key factor in their declining sales. Performing a more detailed analysis in the dataset, we confirmed a high correlation: as young people spend closer to the average price for each bottle of DTC wine, they buy less wine. When they have lower priced options (i.e., buy more wines at a price below the average bottle price)—they do in fact buy more overall.

From the young consumer’s point of view –the cost of the overall DTC wine experience is even more out of reach. The high cost of tasting experiences, bottle prices, added 20% tips, shipping and the disappearance of lower priced wine options on tasting menus taken together create a major hurdle.

The beverage alcohol competition is also a key factor. The plethora of fun and affordable RTDs in recent years effectively target and connect with younger consumers. A bottle of upscale spirits is often deemed a better choice –it’s the same price as a nice bottle of wine yet delivers 16 servings per bottle vs just 5 and lasts months after opening instead of days.

Insight into Action:

Building closer ties and direct relationships today with our core wine consumers of tomorrow is imperative.

Place:

Create new edutainment wine experiences that mix 3D real world and technology for a livelier format.

Focus on growth cities with geo -targeted digital marketing & social media.

Hold events targeting HV younger consumer & their friends where they live and work.

University towns are a great place to target graduate students, young consultants and newly minted doctors or lawyers. Empower newer hirers (ideally recent graduates) to design and conduct these events.

Product:

New and different varietals: younger consumers are open to exploring different wine types and styles and spend more of their dollars here than do older customers. Offer varietals outside the mainstream—ideally priced at or below the average price nationally.

The younger consumer likes the subscription model in almost all aspects of their daily lives. The wine industry excels at this business model. Create a member only “gift” club, which allows longtime (older) club members to gift a less expensive, lower bottle commitment wine club to their friends and family?

Wine is a natural product made from grapes. We are tied to the land. Almost all DTC wineries focus on running sustainable businesses both environmentally and in partnership with our communities and workers. Keep this message front and center in the DTC experience and product marketing.

Price:

Host monthly, more affordable wine experiences at the winery –perhaps at off times so as not to conflict with busier days and times that deliver higher revenue.

At these casual experiences, feature a few wines closer to $35 (Closer to the average bottle price of $36.90).

Ultra-Luxury brands (usually priced out of reach for most younger consumers) could offer events especially for VIP customers and their adult children. (Improve retention of older VIP customers today and build bonds now with younger consumers for future success)

Conclusion:

Whether large or small, every wine brand needs to understand, target, and welcome the young consumer for long term sustainable growth. Start by leveraging data insights to better understand this important wine consumer. Next, expand operations in places, price points and varietals that succeed with this demographic. Finally, adapt marketing and deliver tailored wine experiences to better connect with them today to ensure our industry still thrives tomorrow.

The wine industry is an 8,000-year-old tradition. It’s here to stay. Future success for individual wineries and brands, however, depends on better understanding customers and stepping outside our usual way of doing business. Customer Vineyard looks forward to helping our industry as it moves onward and upward.